December 31, 2023: India’s EV plans for EV30@2030 are solid and futuristic which requires the entire industry and policy makers in the government to come together to achieve the same. As the year 2023 witnessed the Indian auto industry and EV start-ups racing towards an all-electric future across all categories in EV. However the industry faced some challenges and roadblocks with policy makers for the EV transition in India.As the year comes to an end we, at evstory.in are inviting views and opinions from EV industry leaders to reflect on the Year 2023

By Subhabrata Sengupta & Mudit Yadav, Avalon Consulting

Beneath the rhythmic symphony of honking horns and sputtering engines, a quieter melody is emerging on India's bustling streets. Electric vehicles (EVs) are no longer futuristic whispers, but tangible presences zipping past chai stalls and weaving through rickshaw traffic. The Indian EV market, like a young sapling braving monsoon winds, has weathered its share of sun and shade.

In this article, we'll peel back the layers of the latest sales data, analyse the impact of the recent FAME-II subsidy withdrawal, and understand why, despite temporary slowdowns, the future of Indian EVs remains an electrifying prospect. Buckle up, as we navigate the twists and turns of this green revolution and discover why India might just become the EV powerhouse of the future.

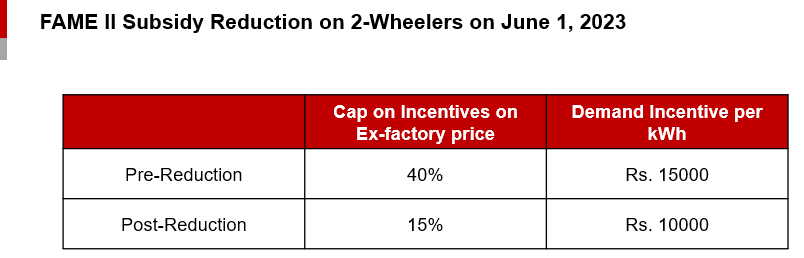

The government has reduced the subsidy provided under the FAME-II (Faster Adoption of Manufacturing of Electric Vehicles in India) scheme applicable to electric two-wheelers registered on or after June 1, 2023. For electric two-wheelers, the demand incentive will be Rs 10,000 per kWh. The cap on incentives for electric two-wheelers will be 15 per cent of the ex-factory price of vehicles from 40 per cent at present.

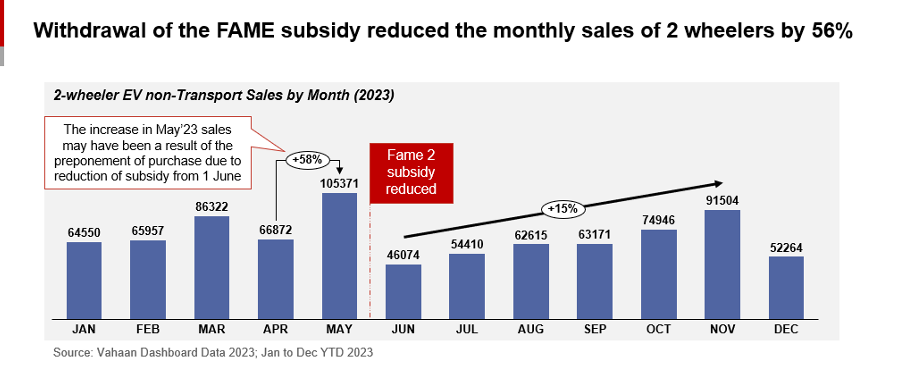

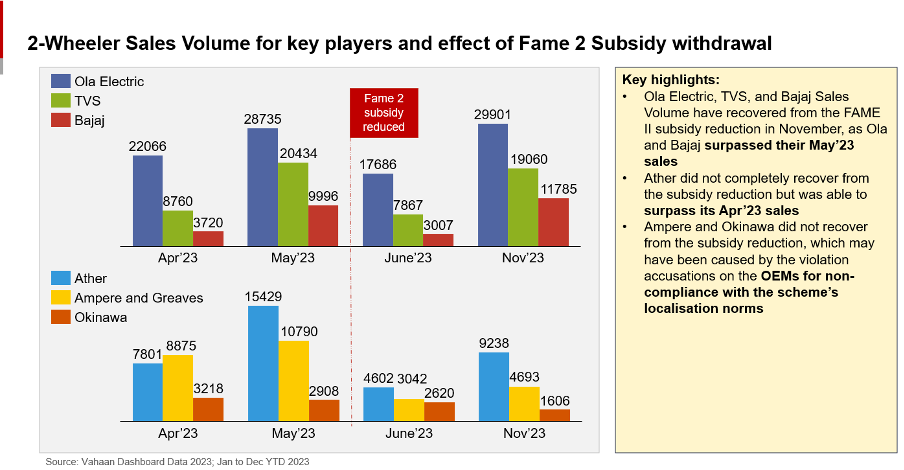

Major OEM Brands like Ola Electric, TVS and Bajaj Auto have completely recovered from the reduction in Sales but on the other hand brands like Ather and Okinawa have struggled with only managing 55-60% of their May’23 Sales which may have been caused by the violation accusations on the OEMs for non-compliance with the scheme’s localisation norms.

Looking at the overall picture of 2-wheeler sales, the market has grown by 33% as of date from last year. Even with the reduction in subsidy, the sales in June’23 did not fall below last year's sales figures of Jun’22. This growth has improved through improvement in charging infrastructure and penetration into T-2 and T-3 markets where the demand for 2-wheelers is higher.

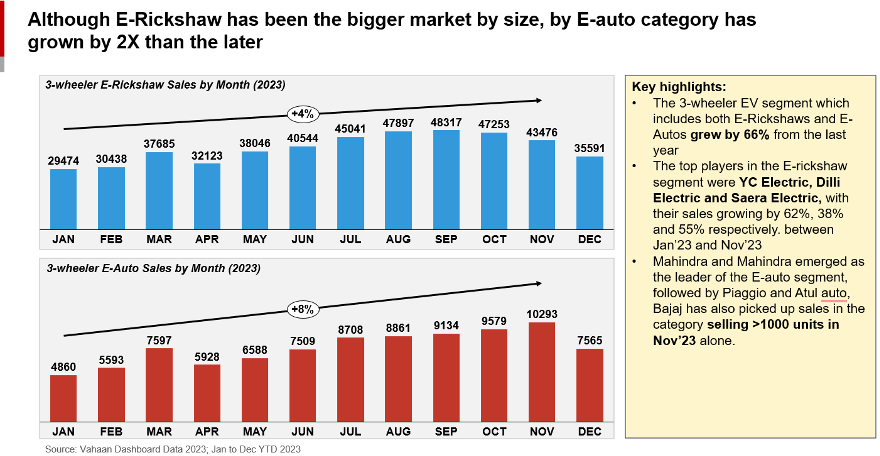

In the dynamic three-wheeler electric vehicle (EV) market, sales, particularly in the commercial vehicle segment, have witnessed an impressive 62% growth compared to the previous year, notably surging in the latter half of 2023. This momentum can be attributed to a combination of factors, including escalating CNG prices since 2022, operational cost advantages beyond fuel, a growing network of battery swapping stations, and government initiatives such as the FAME subsidy at Rs. 10,000 per kWh.

Note: A large section of e-rickshaw sales are non-registered, non-subsidy vehicles and not captured in Vahan data. Excludes Telangana

Despite a higher initial investment, the adoption of three-wheeler EVs has remained consistent. The market is divided into two primary categories: E-rickshaws and E-autos. Notably, E-autos have experienced a remarkable 2X growth in Month-on-Month Sales compared to E-rickshaws.

Key players leading the E-rickshaw category include YC Electric, Saera Electric, and Dilli Electric. In the E-auto category, Mahindra and Mahindra, Piaggio, and Atul Auto are prominent leaders. Both categories offer products for passenger and commercial use, featuring swappable and non-swappable battery technologies. The robust growth in three-wheeler EV adoption underscores the industry's resilience, driven by a strategic alignment of market forces, technological advancements, and supportive government policies.

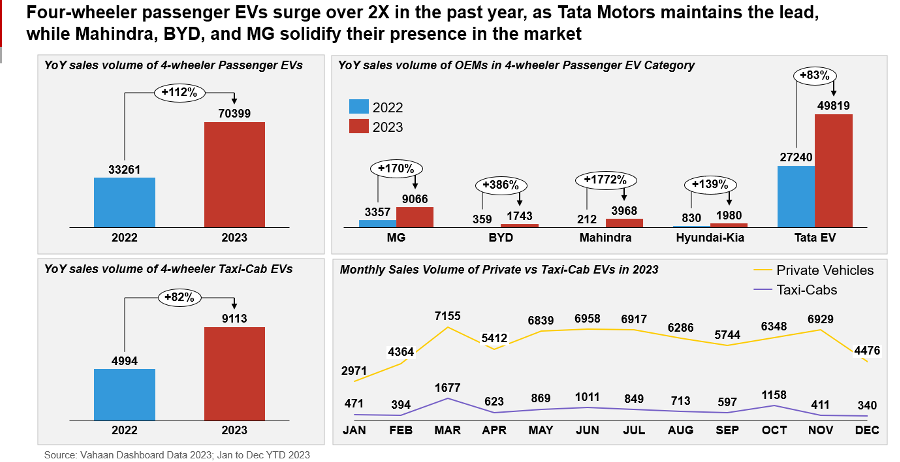

The four-wheeler EV passenger vehicle market has seen remarkable growth, with annual sales surging by 112% from the previous year. Also, there was 82% growth in the Taxi-Cab Segment from the last year as well. This consistent expansion is evident in the sustained 2X monthly sales, dominated by Tata Motors, closely followed by MG, BYD, and Mahindra who has recently emerged as major player.

This growth is facilitated by a strategic alignment of government support, including multiple Production-Linked Incentives (PLIs) and FAME subsidies, coupled with significant private sector investments from Original Equipment Manufacturers (OEMs) in infrastructure and technology. Factors such as rising fuel prices, reduced GST rates, associated tax benefits, and an expanded vehicle range have collectively influenced a notable shift in customer preferences.

The renewed focus on affordability, exemplified by new models like the MG Comet EV and Tiago EV, has boosted penetration in the sub-10 lakh market.

A noteworthy trend is the increasing popularity of hybrid vehicles in India, emerging as a practical and long-term solution for consumers, but it is an evolution to the ICE vehicles rather than being a substitute for EVs. Toyota, a market leader in hybrid vehicles, strategically introduced hybrid options across its product lineup, capturing the attention of buyers in the market. This shift may soon be replicated by other OEMs.

By While we find ourselves falling short of our EV30 goal, with only 5% of two-wheelers and slightly over 2% of four-wheelers sold this year being electric vehicles (EVs), there is notable progress in the heavy vehicles segment. A commendable 12% of vehicles sold in this category are EVs, indicating a positive trend in larger, more impactful vehicles.

Despite the current figures, achieving our goals remains within reach. Substantial investments in battery infrastructure, aimed at enhancing range, coupled with ongoing improvements and investments in charging infrastructure, lay a solid foundation. The political landscape is also conducive, with continuous support for manufacturers through Production-Linked Incentives (PLIs) and subsidies like FAME, enhancing the appeal of EVs for consumers.

It's crucial to acknowledge the short-term challenges, including a slowdown in sales, without losing sight of the overall positive trajectory. The green revolution through EVs has successfully shaped a favourable public perception, and this momentum is likely to persist in the long run. Government initiatives advocating for adoption further strengthen the market's outlook, emphasizing that short-term fluctuations do not undermine the enduring success of the EV industry.

By Jayakumar G President & Managing Director Valeo

In the year 2023, the Indian automotive market witnessed significant growth in the passenger vehicle segment, especially in the SUV category. The Electric Vehicle (EV) segment is growing much faster than predicted. In the next five years we expect that 3 Wheelers and 2 Wheelers will grow at a faster pace compared to 4 Wheelers. We see that almost every Passenger Vehicle OEM present in India has committed themselves to bringing EV models in India and working on multiple models of EVs. Today, the subsidies and incentives are supporting the initial purchase cost. Eventually with the reducing cost of batteries, with scalable volumes and deeper localisation, the costs of EVs will come down. Consumer sentiment suggests that a vast majority of people are eying EVs for their next car purchase, with a clear preference for full battery electric vehicles over plug-in hybrid electric vehicles. This growth in demand for EVs is shaping the automotive retail journey in India.

It is essential to push for more EVs for a sustainable future. Of course the Energy should be greener, and the industry with government support has to massively invest in renewable energy which will help in reducing Co2 emissions.

At Valeo, we have our strategy for Greener, Smarter and Safer mobility. Globally, we have the technologies for electrification in low voltage and high voltage segments- electric powertrain, on board chargers, DC DC converter and 3 in 1 combination units , Battery thermal cooling are some of the products we have brought to India to support our customers in the journey towards greener mobility.

Recently, Valeo has been chosen by Mahindra & Mahindra to provide electric powertrain for a certain range of their ‘Born Electric’ passenger vehicle platform and onboard charger combo for their electric utility vehicle, for an order value close to USD One Billion. Our investments are going more towards electrification and deeper localisation. If you see our growth, we are above the market because the content per vehicle is increasing and all the new technologies have a much higher value. In the words of our global CEO, “we are at the start of a period in which the transformation of mobility will drive hyper-growth in the electrification and ADAs markets for 15 to 20 years”

India’s automotive market is at the start of a major transition towards electrification. To encourage increased EV adoption major structural challenges like high pricing, range-anxiety, limitations in charging infrastructure have to be addressed. Along with focused interventions like talent development in electronics/ software and scaling up charging infrastructure, the macro elements like policy support, safety improvements, battery price decline are all expected to help growth of the EV segment in the next 5 to 10 years. We at Valeo are working on local manufacturing of the products for Electrification and fully geared up to support the EV market growth in India.

Accelerating India's Electric Vehicle Revolution: Policies, Progress, and Potential

By -Saket Sapra, Managing Director - Dana TM4 India, Head of Electrification, India & Southeast Asia & Abhay Soman – Director Business Development – Dana TM4 India, Southeast Asia

India stands at the cusp of an electric vehicle (EV) revolution, driven by the forward-thinking policies and schemes of the Indian Government. According to a recent report by Bain & Company and Blume Ventures, India's electric vehicle (EV) market has the potential to achieve around 40 per cent penetration with $100 billion revenue by 2030, a substantial increase from the present 5 per cent penetration, if policymakers address some key challenges.

In November 2023, India witnessed a commendable 9.54% month-on-month increase in EV sales, totalling 1,52,514 units. Notably, the year-on-year surge of 27.15% from November 2022 underscores the growing momentum in EV adoption. However, it is critical that the Government incentives and policies, stay the course. Apart from the much spoken about benefits such as reduced oil imports, reduced pollution, performance characteristics of vehicles, Battery Electric Vehicles (BEV) also exceed the ‘Well to Wheel’ efficiency compared to various other fuel types such as Diesel, Petrol, Hybrids and CNG.

FAME 2 along with Production Linked Incentive Schemes for batteries, auto components and EVs, armed with a ₹36,000 crores outlay, have become the lynchpin in promoting EV adoption and production. FAME 2 promotion of Lithium-Ion batteries, which now constitute 80% of total EV sales, mirrors a futuristic alignment with emerging battery technologies.

Amongst the slew of schemes and policies introduced by the Government, noteworthy are:

However, the Indian EV industry must overcome challenges for higher penetration as well as wider public acceptance.

The reduction in FAME 2 incentives for 2 wheelers, led to a price increase and a momentarily drop in sales. While there are two sides of the argument for subsidies, for all commercial vehicles (2 wheelers, 3 wheelers, Passenger cars & Buses), considering the Total Cost of Ownership (TCO) for electric showing better or comparative costs (depending on the study), versus ICE, private use electric vehicles still need incentivisation. Further, the unspent portion of the allocated FAME 2 budget raises questions about utilization efficiency. As FAME 2 concludes after March 31, 2024, the need for continued demand-side incentives is critical to keep up the momentum for increased penetration. Initial acquisition costs, new technology, range anxiety, lack of charging infrastructure continue to worry consumers. Therefore, the Government should extend FAME for a few years to mobilise demand to allow economies of scale for the various PLI schemes and the large associated investments to be effective. The next tranche of FAME incentives could look at mandating higher localisation and range in electric vehicles, in addition to increased allocation towards charging infrastructure.

The challenges in the PLI schemes for Auto and Auto Components are multifaceted, with only three OEMs so far meeting the qualifying criteria and none so far among the 75 auto component applicants. Some auto component manufacturers are facing major challenge for durability testing of their products as sufficient testing equipment are not available in India. Complicated application processes, delayed payouts and large investments add to the manufacturer’s woes. The Government should support test agencies to rapidly enhance testing capabilities, consider benefits to be paid out on a more frequent basis e.g. quarterly. Large capital investment (Rs. 250 Crores in 5 years) has also been a cause of concern for small and medium sized enterprises. The Government could relook at the total investment required, extend the present definition of “Other Battery Electric Vehicles”, and extend the period of the PLI by 1-2 years, considering the scheme benefits were to start in Financial Year 2022-2023.

The Battery PLI scheme could be relooked at to address the gap between the 2030 GWH requirement and the current eligible capacity. There have been some concerns on tough timelines, demanding technology requirements (e.g. energy density) and difficult value addition norms. India should also consider allocation of funds for research on alternate battery technologies suitable for Indian conditions. Establishing a Central Battery Research Institute for standardisation and for fostering a circular economy for batteries, with policies promoting second-use applications, recycling, and refurbishing is required.

Charging infrastructure poses a major challenge considering about 1.3 million chargers required by 2030, compared to less than 10,000, we have today. Presently 3 different charging standards exist. The upkeep of the existing charging and power grid infrastructure needs attention. Apart from investment outlay and incentives, it is critical to bring in uniformity of standards and ensure proper upkeep of the infrastructure being put in place. New laws for construction of buildings, malls etc. to have compulsory EV charging stations, would also go a long way.

Rare earth magnets and semiconductors play an important role in the EV supply chain. While rare earth resources in India are the 5th largest in the world, heavy rare earth elements essential for electrical vehicles are not available in easily extractible quantities. Further, Indian rare earth resources are tied with radioactivity, making extraction complex & expensive. Active electronics including IGBTs etc. required for automotive grade motors & inverters are not readily available in India. The Government should further lower import duties on these components in the short term. To promote local manufacturing, increases in import duties on components like BLDC motors, PM motors, and inverters is essential.

Acknowledging the nascent stage of EV financing, directing state-owned banks to allocate a percentage of loans for EVs at reduced rates is recommended.

Presently a huge skill gap for service personnel, product and manufacturing engineers exists for electric vehicles. In partnership with the industry, major upskilling programs need to be launched. Global companies such as ours have been depending on our global design and manufacturing resources to resolve these concerns. Today most companies are not designing in India. Frugal design engineering with easily available local materials is a must for price effectiveness as well as local supply chains. Re-evaluating service tax and creating R&D hubs with special incentives to encourage local innovation are recommended.

The above provides a synopsis of the some of the adaptive policies to overcome existing challenges. As India charts its course in the electric vehicle odyssey, collaborative efforts between the government and industry become paramount.

By Uday Narang, Founder, Omega Seiki

In the throbbing heartbeat of India's electric vehicle (EV) revolution, the year 2023 stands as a testament to remarkable strides, with the nation gearing up to meet the ambitious EV30@2030 targets. As of March 2023, the EV market in India has surpassed 2.3 million vehicles, signifying a monumental shift toward sustainable and clean mobility. This comprehensive overview explores the multifaceted dynamics of the electric vehicle landscape, encompassing two-wheelers, three-wheelers, and four-wheelers, both commercial and passenger, while delving into the challenges and promising future.

The EV market's exponential growth is encapsulated in the fact that, as of March 2023, more than 2.3 million electric vehicles traverse the roads of India. This surge underscores a robust acceptance of environmentally conscious transportation solutions, reflecting a collective commitment to a greener and sustainable future. The data not only reflects a numerical milestone but also signifies a paradigm shift in consumer preferences and industry dynamics.

Electric two-wheelers continue to be the stalwarts of India's EV journey, capturing over 90% of the market share. Beyond urban centres, electric scooters and motorcycles have become the favoured choice for a diverse consumer base. The surge in two-wheeler adoption underscores their pivotal role in steering the nation's electric mobility revolution.

Commercial electric three-wheelers have emerged as the backbone of last-mile connectivity in both urban and peri-urban landscapes. The economic benefits, including lower operational costs and a steady income for drivers, contribute to their increasing popularity. While the transition to electric three-wheelers is underway, challenges persist, with a critical need for robust charging infrastructure and a drop in the price to purchase an EV. Collaborative efforts between municipalities and private players can expedite the deployment of charging stations, ensuring the seamless adoption of electric vehicles.

The commercial four-wheeler segment, including electric trucks and fleet vehicles, is gaining traction as businesses recognize the long-term benefits of electrification. Government policies encouraging the adoption of electric vehicles in commercial fleets, coupled with incentives for manufacturers, create a conducive environment for the transition although there is no clarity on the subsidies for electric trucks yet. Additionally, electric buses are becoming integral to sustainable urban mobility initiatives, contributing to reduced emissions and improved air quality. The holistic approach towards electrifying commercial four-wheelers aligns with India's commitment to transforming its entire automotive landscape.

Government incentives play a pivotal role in catalysing the transition to electric mobility. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme, offering subsidies of up to 25% on EV purchases, stands out as a beacon of support. These incentives are instrumental in making electric vehicles more accessible and attractive to consumers, fostering an environment conducive to sustainable transportation.

While the enthusiasm for EVs in India is palpable, challenges persist on the road to widespread adoption. Limited range, insufficient charging infrastructure, and the high upfront cost of electric vehicles remain noteworthy hurdles. Addressing these challenges requires concerted efforts from industry players, policymakers, and stakeholders to ensure a smoother transition to electric mobility. Innovative solutions and collaborative initiatives, especially, between big players and start-ups are crucial to overcoming these obstacles and steering the EV sector toward sustainable growth.

India's commitment to a sustainable automotive landscape is underscored by ambitious targets set by the government. Aiming to have 30% of all vehicle sales be electric by 2030, the nation envisions a comprehensive transformation of its automotive fleet. The holistic approach towards electric mobility, encompassing two-wheelers, three-wheelers, and four-wheelers, reflects a strategic vision for a cleaner and greener future.

Emerging technologies in the EV sector, including advancements in battery technology, energy storage, and smart charging solutions, are contributing to the evolving landscape. The integration of cutting-edge technologies positions India at the forefront of global efforts to adopt sustainable transportation solutions.

In conclusion, the evolving EV landscape in India is marked by significant milestones, robust government support, and a comprehensive approach toward sustainable mobility. The surge in EV adoption, spanning two-wheelers, three-wheelers, and four-wheelers, underscores the transformative journey the nation is undertaking. As India steers towards its ambitious targets, collaborative efforts from all stakeholders will be instrumental in navigating challenges and steering the course toward a cleaner, greener, and more sustainable automotive future. The road ahead may be complex, but with collective determination, innovation, and strategic partnerships, India is poised to lead the way in the global electric mobility revolution.

By Amit Lakhotia, Founder & CEO, Park+

Startup landscape and its projections

“The India startup story is still being written and has immense latent potential. Business which are frugal and are building robust business anchored by realistic valuation will continue to thrive even in the current dynamic environment. 2023 was a year of introspection for a lot of startups, chasing vanity matrixes and unrealistic valuations were two major dampeners, a reality check was much needed in the Indian context. Having said that, 2023 was more of recalibration and realignment for a lot of startups across verticals. 2024 will see the emergence of sustainable and profitable business, backed by a robust revenue generating model. The Indian startup story still has a lot of gas left in its tank.”

Evolving Auto-EV landscape and its projections for 2024

“2023 has been a game changing year for the Indian auto-tech industry. Innovation and disruption across verticals- EV’s, smart mobility, fleet management, smart traffic management systems and digital first solutions for vehicle owners have reenergized the Indian auto ecosystem. The government has also provided an impetus to all external stakeholders on how mobility as a sector can add value to the larger economic momentum. The Indian auto industry, specifically from an EV lense is on the cusp of cementing its position as a leading EV hub. The EV two-wheeler revolution started in India and will have a domino effect on three wheelers, commercial vehicles, and private vehicles. 2024 has the potential of emerging as a year when India reinforces its pole position as a dynamic auto-tech hub in Asia and even globally.”

By Nimish Trivedi, CEO & Co-Founder, Evera

Startup landscape and its projections

"The growth in funding with respect to the Indian EV ecosystem makes waves as we navigate the startup terrain. Despite the funding winter, startups have embraced 32 deals this year, showcasing the sector's robust growth. Significantly, the Indian EV space has attracted more than $780 Mn this year as per the recent industry reports, exceeding the 2022 amount of $758 Mn, showing a strong financial trend. The influx of funds validates our entrepreneurial spirit and drives us into the age of innovation towards sustainability. The flourishing environment indicates strongly the promise startups hold in transforming the way we power our future of electric vehicles, steering towards a greener, and more impactful tomorrow.”

Evolving Auto-EV landscape and its projections for 2024

"In the midst of a revolution stage in the transport sector whereby the ICE era is being replaced by alternative Eco-friendly electric vehicles, the financial route comes out as a main motivator. The drive for electric vehicle finance is an advancement despite the hurdles involved, from purchase motivation to charging platforms. The government, financial institutions, and automakers have been collaborating to make EVs more affordable, but some challenges remain. India will have positive developments for EVs in 2024 with the government’s initiatives like FAME under the National Electric Mobility Mission Plan (NEMMP).

With a visionary goal of 30% EVs on roads by 2030, 2024 holds the promise of increased adoption, innovative models, and affordable pricing. Looking forward, collaborative efforts must intensify to refine financing alternatives, fortify charging infrastructure, and cultivate a second-hand market, ushering in a future where EVs seamlessly accelerate us towards sustainability."

By Ketan Mehta, CEO & Founder, HOP Electric Mobility

"As we enter a new year, I am pleased to share the significant progress HOP Electric Mobility has made in the realms of innovation and sustainability. Our commitment to research and development has reached new heights, demonstrated by our ongoing work, including the development of liquid cooling battery packs. This technological advancement not only represents progress but also enables us to offer warranties on batteries equivalent to the entire lifespan of our electric bikes.

"According to NITI Aayog, the projected size of the two-wheeler EV market is estimated to be between INR 35,000 Crores and INR 40,000 Crores by FY26. India's electric vehicle (EV) industry has notched an impressive milestone, clocking over 1.2 million sales in the first ten months of 2023, surpassing the entire retail sales of the preceding year. Over the past three years, we have experienced notable growth, achieving a 100% annual increase. Looking ahead to 2024, we are currently in the developmental phase of the Nimbus platform, scheduled for launch in the upcoming financial year. This platform features distinctive elements, including our work on rare earth-free magnet electric motors, showcasing our commitment to environmentally conscious technologies."

"As we face the challenges and opportunities of 2024, we look forward to another year of accomplishments, milestones, and a continued journey towards a cleaner, greener future. Here's to a year where innovation meets sustainability, and where HOP Electric Mobility continues to drive positive change."

By Sameer Aggarwal, CEO & Founder Revfin Services

"As 2023 draws to a close, it becomes evident that this year has marked a significant turning point for India's electric vehicle (EV) sector. The industry has not merely achieved sales milestones but has evolved into the year of consolidation, where stakeholders from manufacturers to financial institutions are actively collaborating to create a robust ecosystem for sustainable mobility.

In the backdrop of an impressive 1.2 million EV sales within the first ten months, a testament to the increasing demand for electric two-wheelers for both personal mobility and last-mile deliveries, the sector is experiencing a wave of transformation. This year has seen stakeholders strategically aligning their efforts, epitomized by cost-effective product deals introduced during the festive season.

Looking forward to 2024, the outlook remains promising, with projections indicating that electric two and three-wheelers are poised to surpass the one million mark. Beyond mere sales figures, this signifies the industry's potential, driven by India's expansive market and population.

What sets this year apart is the collaborative spirit that has taken root. It's not just about sales; it's about the year of ecosystem creation. The convergence of efforts from original equipment manufacturers (OEMs), financial institutions tailoring competitive financing options, and government support through incentives and subsidies is shaping a conducive environment for clean energy initiatives.

As stakeholders join forces to revolutionize sustainable mobility, this year has become a beacon for transformation in the transportation landscape. The electric vehicle industry in India is not just growing; it is consolidating, creating ecosystems, and fostering a collaborative approach that will undoubtedly drive transformative shifts in the years to come."

By Mayank Bindal, Founder & CEO, Snap E Cabs

"It has been an incredible and a successful year at Snap-E cabs. We have been able to reach our goals and targets for the year 2023 and eagerly look forward to 2024. With many new strategies coming into shape, we are now in the phase of executing these strategies. We plan to start operations in new cities in 2024. We have new SKU's being built for our customers like Out Station, premium vehicles and hourly rentals. We have new opportunities from our B2B clients and we look forward to building stronger relationships with them in the future. We look forward to working closely with new technology partners and charging partners to improve and make the entire experience delightful to our customers and making efficient sustainable business in the process. Thanking and wishing all our costumes and clients a very happy new year and may the coming year bring all the happiness and joy in their lives. We will keep providing the services as per our commitments and hope to serve the community and give back a reliable, eco friendly & a comfortable ride in the future."

By VG Anil, CEO, ARENQ

"In this dynamic year for batteries, we've reshaped energy norms. From driving EVs toward eco-friendliness to extending solar power's reach, batteries have been key. They're not just power sources; they're symbols of our green commitment. Solar's after-hours prowess and UPS reliability owe much to battery might, ensuring uninterrupted operations. These strides exemplify our pursuit of sustainability and efficiency. Reflecting on our progress, let's push battery tech boundaries, scaling sustainability. Together, we'll keep powering a cleaner future, uniting innovation with lasting environmental impact."

By Akshit Bansal, CEO & Founder, Statiq.

"India, ranking third globally in energy consumption, is steering towards a net-zero carbon goal by 2070, with a crucial emphasis on sustainable mobility. The evolving landscape of the transportation sector is witnessing a radical transformation, with the widespread adoption of electric vehicles (EVs) emerging as a key strategy to curb carbon emissions. The Indian EV market is experiencing notable expansion, with a particular focus on meeting the surging demand for cleaner transportation, which is also necessitating a parallel expansion of charging infrastructure to cater to escalating demand. We, at Statiq, have taken a significant step in this direction by deploying 7,000 charging stations across tier 1, tier 2, and tier 3 cities. These installations, strategically placed in locations such as Nexus Koramangala Mall, Bengaluru, Nexus Esplanade in Bhubaneswar, Nexus Centre City Mall in Mysuru, Padam High Street Mall, Agra, Hilton Inn, Delhi, Fun Republic Mall in Lucknow, Ramada Encore By Wyndham, Bareilly in Uttar Pradesh, and Nexus Fiza Mall in Mangaluru among others. To ensure widespread compatibility, Statiq's charging stations support a spectrum of electric vehicles, including popular models like Tata Nexon, MG EVZS, Tata Tiago EV, and more. We have also recently introduced a groundbreaking feature, StatiqConnect, which revolutionises the EV user experience. This industry-first innovation consolidates critical information, such as charging data and driving range, within the Statiq app, eliminating the need for multiple OEM apps and providing users with seamless access to vital data in real-time. In line with our commitment to quality and accessibility, Statiq is steadfast in its pursuit of deploying 20,000 EV charging stations by 2025. The momentum in India's electric vehicle market is set to grow substantially, driven by government policy interventions, technological advancements, cost-effective mobility options, and an increasing environmental consciousness among consumers. The shift towards green mobility is poised to accelerate, paving the way for a healthier and sustainable transportation future”

By Manjula Girish, Business Head- EV Charging and Photovoltaic Inverter division, Delta Electronics India.

The electric vehicle (EV) industry is poised for substantial growth in the coming year, fueled by burgeoning consumer demand and continuous technological advancements. As an increasing number of consumers embrace electric vehicles, the need for a robust and reliable charging infrastructure becomes even more paramount.

While the EV industry has witnessed consistent progress over the years, there are still challenges that require attention. A primary hurdle lies in the scarcity of charging stations, particularly in rural and remote areas, creating a significant barrier for potential electric vehicle buyers. The apprehension of not having access to a charging point can act as a deterrent. However, this challenge simultaneously presents a strategic opportunity for companies to invest in expanding the charging network and penetrating untapped markets.

Another noteworthy challenge revolves around the time required to charge an electric vehicle. Despite the introduction of fast-charging solutions, their widespread availability is still a work in progress. This limitation may dissuade potential EV owners accustomed to the convenience and speed of refueling a traditional gasoline vehicle. Yet, ongoing research and development in battery technology instill confidence that improvements in charging times are on the horizon.

On a positive note, the EV industry not only presents numerous opportunities for innovation and job creation but also aligns with the 'Make in India' initiative. As the demand for electric vehicles rises, there will be an increasing need for skilled professionals to design, manufacture, and maintain EVs and their associated infrastructure. This scenario opens a promising pathway for individuals seeking entry into the flourishing green technology sector, contributing to the creation of a sustainable ecosystem of mobility.

Moreover, the transition to electric vehicles contributes to environmental benefits. With zero tailpipe emissions, EVs play a pivotal role in fostering cleaner air and combating climate change. This positive environmental impact further highlights the potential of the EV industry and underscores the need for continued investment in its growth.

In conclusion, the EV industry and charging infrastructure face challenges such as the scarcity of charging stations and longer charging times. However, these challenges simultaneously present opportunities for companies to invest in expanding the charging network and for individuals to carve a niche in the growing green technology sector. With advancements in technology, increasing consumer demand, and government support, the EV industry is not just poised for growth next year; it is positioned to lead the way in a sustainable revolution in the mobility landscape.

By Srihari Mulgund, EY-Parthenon India New Age Mobility Partner

Electrification in India is driven by the two-wheeler, three-wheeler[1] (L5), and bus segments, achieving penetration rates of approximately 5%, 12%, and 9% in 2023[2], respectively. Passenger vehicles and light commercial vehicles are lagging, with less than 2% and less than 1% penetration, respectively, while electrification in medium and heavy commercial vehicles is nearly non-existent.

The growth observed in these segments can be attributed to the following factors:

The indications are clear that the segments (Passenger Vehicles, Light Commercial Vehicles, Buses, and Trucks) covered under EV30@2030 have experienced lower EV penetration, except for buses

While the Total Cost of Ownership (TCO) benefits for electric vehicles (EVs) are significant, reducing the upfront cost is crucial to achieving better EV penetration. The government's support through fiscal incentives and regulations has provided the necessary initial thrust for the two/three-wheeler segments by helping to cut down the upfront cost. However, EV sales remain sensitive to incentives, and extending the scheme to other segments is necessary to align with EV30@2030 targets. For example, under FAME II, only commercial passenger vehicles were included, excluding private cars, which constitute the majority of sales in the segment. Efforts to enhance charging infrastructure need to persist. On the supply side, Original Equipment Manufacturers (OEMs) are expected to adhere to their EV launch plans, with most anticipated launches in 2024 from Tata, Suzuki, Mahindra, Hyundai, Kia, etc. To address the higher acquisition cost issue, OEMs should explore a consortium approach to building a unified charging infrastructure and sharing EV platform development costs. This approach would help reduce development time and costs, improve time to market, and reduce the risk exposure for the OEMs. For instance, BMW, Ford, Hyundai, Mercedes, and Volkswagen have established a joint venture – IONITY – to establish a high-power charging network across 24 EU countries.

To summarize, electrification focused on key segments like passenger vehicles is crucial, and the intentions of the government are evident through initiatives like FAME II, PLI, etc. The industry's ability to reduce upfront costs in the next 18-24 months through collaboration is key to driving sustainable EV adoption in the medium to long term.

[1] L3 (E-Rickshaw) segment is an electric low speed three-wheeler with 461,000 registrations between Jan-Nov 2023

[2] Registrations pertaining to Jan-Nov 2023

EVStory.in - India's best EV Portal

EVStory.in - India's best EV Portal