By Bloomberg NEF

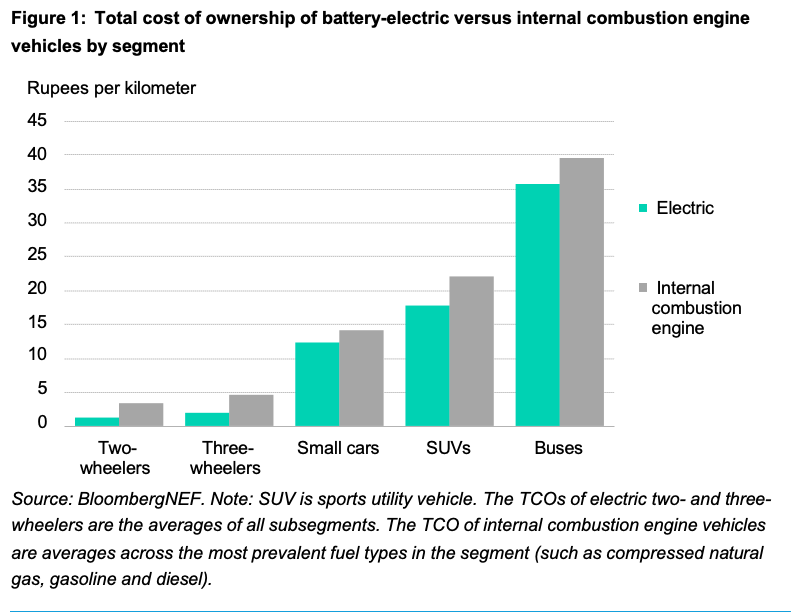

March 13, 2024: The lifetime costs of electric vehicles in India are less than those of internal combustion engine models across most vehicle segments, which facilitates adoption, especially for low-speed two- and three-wheelers. The lower total cost of ownership, or TCO, favors EV use in high-mileage applications such as urban deliveries, ride-hailing and intra-city public transit. Despite favorable TCOs across most vehicle segments, EVs still face barriers to uptake, such asconsumer concerns around resale value, charger availability and a lack of affordable finance to fund purchases. Here are some excerpts from

BloombergNEF’s latest report on TCOs in India.

• Small passenger EVs face competition from compressed natural gas (CNG) vehicles:

Electric cars in the small segment are already cheaper than comparable gasoline vehicles on a TCO basis. And by 2027, EVs will become the least-cost option (in TCO terms) in the small electric car segment in India. BNEF estimates the TCO of CNG cars is 6% lower than similar EVs in 2024. In the ride-hailing segment, small EVs already have the lowest TCO, but CNG cars offer stiff competition. Most drivers in the ride-hailing segment own their vehicles and may prefer CNG over EVs due to lower upfront costs and a more developed refueling infrastructure.

• E-buses have a strong economic case for deployment on inter-city routes:

Longer distances favor electric buses over diesel and CNG due to comparatively lower refueling and maintenance costs. The TCO of an e-bus is 26% lower than that of a diesel variant if they cover 250 kilometers in a day, BloombergNEF analysis shows. This benefit increases to 31% if the buses cover 300 kilometers. E-bus operators plying their vehicles on long-distance routes need to ensure that there are sufficient fast chargers available throughout the journey.

• Electric three-wheelers will need additional support despite their TCO advantage:

Electric three-wheelers are already much cheaper than their internal combustion engine (ICE) counterparts in terms of TCO in both low- and high-speed segments. This cost advantage has helped increase sales in the low-speed entry-level segment, where the TCO benefits of EVs outweigh their inferior driving ranges and top speeds. In the high-speed segment, EV uptake could be slower due to higher upfront prices and limited availability of affordable vehicle loans.

• The economics of EVs in the heavy trucking sector only become favorable after 2030:

For urban and regional duty cycles, EVs are already the most economical option across most light-duty commercial use cases. This is due to a combination of factors such as declining battery costs, modest driving ranges, and the relatively large efficiency penalty for diesel trucks in urban traffic. On the other hand, battery-driven heavy trucks on long-haul duty cycles will only reach TCO parity with diesel after 2030.

• Focused interventions are required to boost EV adoption:

The TCO of EVs in most vehicle segments is already lower than comparable ICE vehicles. However, this might not be enough to drive EV adoption. There are some additional risks and uncertainties that could prompt consumers to push back on their EV purchases by a few years and choose an ICE instead. Greater availability of robust after-sales infrastructure and services, anadequate charging network and access to affordable vehicle finance are required to alleviate the most pressing customer concerns around EVs.

Figure 1: Total cost of ownership of battery-electric versus internal combustion engine

EVStory.in - India's best EV Portal

EVStory.in - India's best EV Portal